Now that you’ve learned the basics of creating a basic forex expert advisor, it’s time to hunt for the next mechanical system to automate.

This week, I’m taking a look at my wingman Big Pippin’s SMA Crossover Pullback framework.

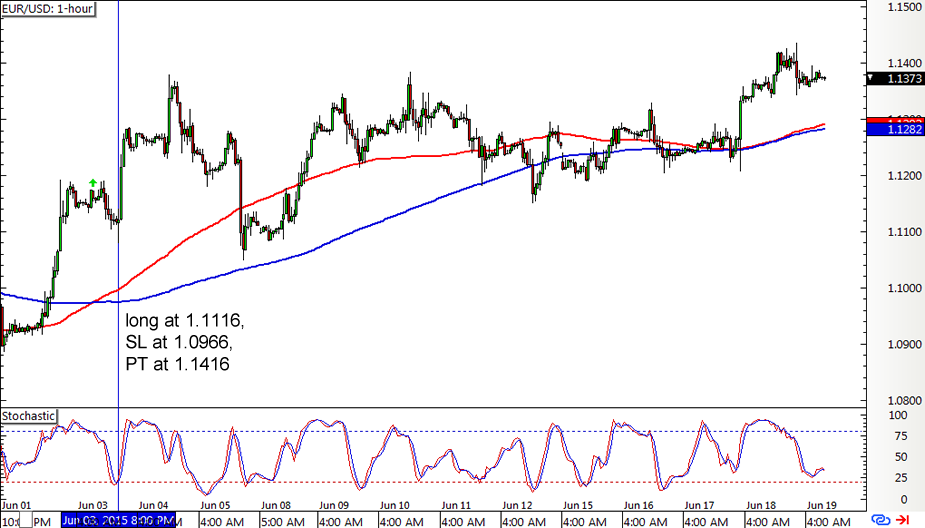

If you regularly check his Daily Chart Art updates, you’d know that he uses a combination of simple moving averages (100 and 200 SMA) and the stochastic (14, 3, 3) indicator.

While he uses these mostly as confirmation for a somewhat discretionary approach, I think it could also work as a mechanical system.

Technical Indicators

- 100 SMA (red)

- 200 SMA (blue)

- Stochastic (14, 3, 3)

Entry Rules

BUY on the first instance that Stochastic pulls up from the oversold area (25.00 level) after an upward SMA crossover takes place.

SELL on the first instance that Stochastic drops down from the overbought area (75.00 level) after a downward SMA crossover takes place.

If that sounds a bit confusing, here’s a chart to illustrate valid buy and sell signals:

Exit Rules

Set a 150-pip stop and a 300-pip profit target for a 2:1 reward-to-risk ratio per trade. Move stop to entry once price moves 150 pips in the trade’s favor.

Easy peasy, right? But before we start putting our coding skills to the test by automating this system, let’s see how it fares over the next few months first.

I’ve also been running the numbers since last month and so far it’s been looking good. Stay tuned for my next entries to see if this could be a profitable forex EA!