A Marubozu is a long or tall Japanese candlestick with no upper or lower shadow (or wick).

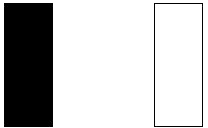

The candlestick pattern comes in both a bearish (red or black) and a bullish (green or white) form and is easy to spot due to its long body.

It basically looks like a vertical rectangle.

To identify a Marubozu candlestick pattern, look for the following criteria:

- The single candle involved in the signal should have a long body.

- There must not be an upper or a lower shadow (or wick).

- The candle can be white/green or black/red, and it can appear anywhere on the chart.

- A white/green Marubozu moves upward and is very bullish.

- A black/red Marubozu moves downward and is very bearish.

- The longer the candle is, the stronger the price move.

A bullish Marubozu is called a White Marubozu and a bearish Marubozu is called a Black Marubozu.

Meaning

The word marubozu means “bald head” or “shaved head” in Japanese, and this is reflected in the candlestick’s lack of shadows.

When you see a Marubozu candlestick, the fact that there are no shadows tells you that the session opened at the highest price and closed at the lowest price of the day.

In a bullish Marubozu, the buyers maintained control of the price throughout the session, from the opening to the close.

In a bearish Marubozu, the sellers controlled the price from the opening to the close.

To better analyze a specific Marubozu, observe the following:

- If a White Marubozu occurs at the end of an uptrend, a continuation is likely.

- If a White Marubozu occurs at the end of a downtrend, a reversal is likely.

- If a Black Marubozu occurs at the end of a downtrend, a continuation is likely.

- If a Black Marubozu occurs at the end of an uptrend, a reversal is likely.