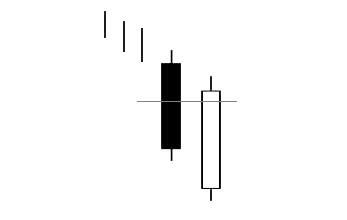

The Piercing Line pattern consists of two candlesticks, that suggests a potential bullish reversal.

The candlestick pattern is likely named piercing because of the way the white candle’s close “pierces” through the midpoint of the previous black candle.

The Piercing Line pattern involves two candlesticks with the second candlestick opening lower (or gapping down) than the previous candle.

This is followed by buyers driving prices up to close above 50% of the body of the first candle.

This pattern is a warning sign for sellers since a reversal to the upside might be imminent.

Recognition Criteria

To identify a Piercing Line pattern, look for the following criteria:

- There must be a clear and definable downtrend in progress

- The first candlestick (which appears at the end of the downtrend) must be a bearish candlestick.

- The second candlestick must be a bullish candle.

- The second candlestick must open below (gap down) the black candlestick and close above the black candlestick’s midpoint.

- If you mark a line through the vertical center of the black candlestick, the white candle must close above it.

Meaning

Shown by the first candle, since the price is clearly in a downtrend. the bears are in control.

On the second candle, although the bears continue pushing the price down at the start of the session, the bulls jump in and fight back.

The price turns around dramatically, finishing near the high of the session. It has almost (but not quite) recovered from the previous candle’s price decline.

To analyze a specific Piercing Line pattern, observe the following:

- The longer the two candles are, the more forceful the reversal.

- The greater the gap down from the black candle to the white candle, the more powerful the potential reversal.

- The higher the white candle closes on the black candle, the more probable the reversal.

The Piercing Line is the opposite of the Dark Cloud pattern, which a bearish reversal pattern that appears after an uptrend warning of “rainy days” ahead.