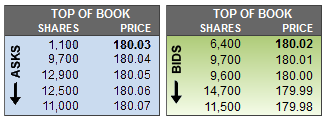

Top of Book represents the highest bid and the lowest ask that time.

They are interesting because they signal the prevalent market and the bid and ask price that would be needed to get an order fulfilled.

The best ask is the lowest ask, and the best bid is the highest bid.

If the ask was lower than the bid then they are considered “crossed.

This would be a “crossed market” and quickly resolved.

So the bid will almost always be cheaper than the ask

“Top” in the sense of the “top of the book” is a ranking (by order of “best”, different for bids vs. asks) and not meant to be strictly a visual positioning on a page or screen.

Think of the “book” as the model, the abstract collection of outstanding bid and ask order data.

When people talk about the “top of the book”, they’re talking about the best bids (higher being better), and the best asks (lower being better).

The visual representation above is but one possible way to render a tip-of-the-iceberg view of the best orders in the “book”.

The advantage of that particular visual representation is that one can see the asks & bids converging towards the center.

The spread is visible as the difference between the two middle elements – being the lowest row in the blue “Asks” area, and the highest row in the green “Bids” area.