There is one other way to incorporate pivot points into your forex trading strategy, and that’s to use it to gauge market sentiment.

What this means is that you can tell whether traders are more inclined to buy or sell the currency pair.

All you would need to do is to keep an eye on the pivot point. You could treat it like the 50-yard line of an American football field.

Depending on which side the ball (in this case, price) is on, you can tell whether buyers or sellers have the upper hand.If the price breaks through the pivot point to the top, it’s a sign that traders are bullish on the pair and you should start buying the pair like it’s a Krispy Kreme donut.

Here’s an example of what happened when the price stayed above the pivot point.

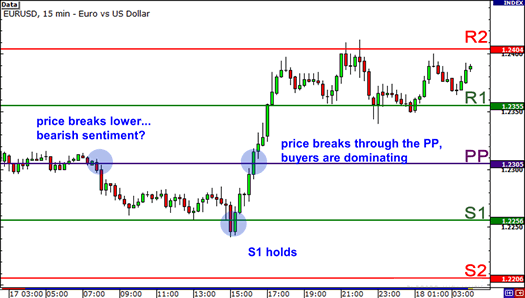

In this example, we see that EUR/USD gapped up and opened above the pivot point.

The price then rose higher and higher, breaking through all the resistance levels.Now, if the price breaks through the pivot point to the bottom, then you should start selling the currency pair like it’s Enron or Theranos stock.

The price being below the pivot point would signal bearish sentiment and that sellers could have the upper hand for the trading session.

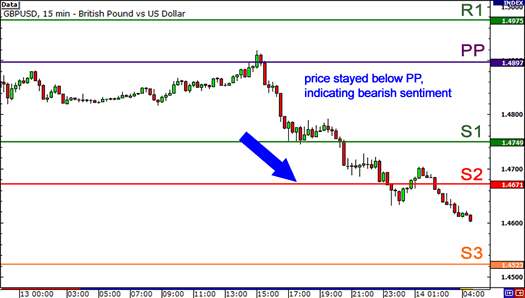

Let’s take a look at a chart of GBP/USD.

In the chart above, we see that the price tested the pivot point, which held as a resistance level. Next thing you know, the pair keeps going lower and lower.

If you had taken the clue that price remained below the pivot point and sold the pair, you would have made some nice moolah. GBP/USD dropped almost 300 pips!Of course, it doesn’t always work out like this.

There are times when you think that forex traders are bearish on a pair, only to see that the pair reverses and breaks through to the top!

In this example, if you saw price breaking lower from the pivot point and sold, you would have had a sad, sad day.

Later on, during the European session, EUR/USD popped higher, eventually breaking through the pivot point. What’s more, the pair stayed above the pivot point, showing how buyers were rockin’ away.

The lesson here?

Traders are fickle!

How forex traders feel about a currency can shift dramatically day to day, even session to session.This is why you cannot simply buy when the price is above the pivot point or sell when it is below it.

Instead, if you choose to use pivot point analysis in this way, you should combine it with other indicators to help you determine overall market sentiment.