If you’ve traded stocks, you’re probably familiar with all the indices available such as the Dow Jones Industrial Average (DJIA), NASDAQ Composite Index, Russell 2000, S&P 500, Wilshire 5000, and the Nimbus 2001.

Oh wait, that last one is actually Harry Potter’s broomstick.

Well if U.S. stocks have an index, the U.S. dollar can’t be outdone.For currency traders, we have the U.S. Dollar Index (USDX).

And to be technically correct, the ICE U.S. Dollar Index.

The U.S. Dollar Index consists of a geometric weighted average of a basket of foreign currencies against the dollar.

Say whutttt!?!

Okay before you fall asleep after that super geeky definition, let’s break it down.

It’s very similar to how the stock indices work in that it provides a general indication of the value of a basket of securities.

Of course, the “securities” we’re talking about here are other major world currencies.The US Dollar Index Currency Basket

The U.S. Dollar Index consists of SIX foreign currencies. They are the:

- Euro (EUR)

- Japanese Yen (JPY)

- British Pound (GBP)

- Canadian dollar (CAD)

- Swedish Krona (SEK)

- Swiss Franc (CHF)

Here’s a trick question. If the index is made up of 6 currencies, how many countries are included?

If you answered “6”, you’re wrong.

If you answered “24”, you’re a genius!

The euro is the official currency of 19 of the 27 member states of the European Union.

Add the other five countries (Japan, Great Britain, Canada, Sweden, and Switzerland) and their accompanying currencies.

And you get 24!

It’s obvious that 24 countries make up a small portion of the world but many other currencies follow the U.S. Dollar index very closely.

This makes the USDX a pretty good tool for measuring the U.S. dollar’s global strength.

USDX can be traded as a futures contract (DX) on the Intercontinental Exchange (ICE).

It is also available in exchange-traded funds (ETFs), contracts for difference (CFDs), and options.

ICE U.S. Dollar Index®

From a legal perspective, the designations “U.S. Dollar Index,” “Dollar Index” and “USDX” are trademarks and service marks of ICE Futures U.S., Inc.

The U.S. Dollar Index is the exclusive property of ICE, also known as Intercontinental Exchange Group.

Intercontinental Exchange Group (ICE) is a global exchange, clearing, financial data, and technology company, operating multiple markets and services across nine different asset classes.

ICE operates 13 regulated exchanges, including ICE futures and OTC exchanges in the US, Canada, Europe, and Singapore. It also is the parent company of the well-known New York Stock Exchange.

Today, the company is among the largest exchange groups in the world.

So if you see “ICE U.S. Dollar Index®“, now you know why. It’s privately owned and trademarked.

Since the inception of futures trading on the U.S. Dollar Index in 1985, ICE compiles, maintains, determines, and weights the components of the U.S. Dollar Index.

The U.S. Dollar Index can be traded as a futures contract for 21 hours a day on the ICE platform. The U.S. Dollar Index futures contract derives its liquidity directly from the spot currency market, estimated to have a turnover of over $2 trillion daily.

Futures contracts based on the U.S. Dollar Index were listed on November 20, 1985. Options on the futures contracts began trading on September 3, 1986. U.S. Dollar Index futures and options on futures are available exclusively on the ICE electronic trading platform.

The ICE U.S. Dollar Index futures contract is the only publicly available, regulated market for U.S. Dollar Index trading allowing virtually round-the-clock access to futures traders around the world.

This is why the ICE U.S. Dollar Index (USDX) futures contract is considered the leading benchmark for the international value of the U.S. dollar and the world’s most widely recognized traded currency index.

USDX vs. DX vs. DXY

If you’ve Googled “U.S. Dollar Index”, you might’ve seen three acronyms associated with the phrase: USDX, DX, and DXY and wondered, “What the heck is the difference between them?!”

What is USDX?

USDX is the umbrella term for the U.S. Dollar Index. You can’t go wrong using this term if you’re talking about the original dollar index.

What is DX?

The ICE Exchange symbol for the futures contract is DX, followed by the month and year code.

The ICE Exchange symbol for the value of the underlying Dollar Index (sometimes called the cash or spot index) is also DX (without a month or year code), although different data providers may use different symbols.

What is DXY?

DXY is a popular ticker or symbol used by Bloomberg Terminal users so that index is sometimes referred to as the “Dixie.”

DXY is more commonly used when referring to the dollar cash or spot rate, while DX is geared more for futures traders. Although as mentioned, DX can also refer to the spot rate as well. Confusing right? 🤯

US Dollar Index (USDX) Components

Now that we know what the basket of currencies is composed of, let’s get back to that “geometric weighted average” part.

Because not every country is the same size, it’s only fair that each is given appropriate weights when calculating the U.S. dollar index.

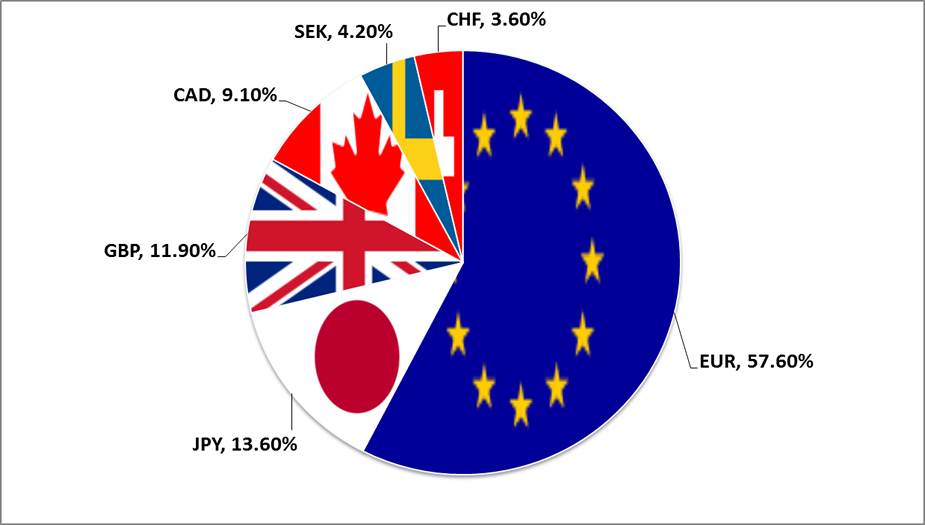

Check out the current weights:

With its 19 countries, euros make up a big chunk of the U.S. Dollar Index.

The next highest is the Japanese yen, which would make sense since Japan has one of the biggest economies in the world.

The other four make up less than 30 percent of the USDX.

Here’s a question…When the euro falls, which way does the U.S. Dollar Index move?

The euro makes up such a huge portion of the U.S. Dollar Index, we might as well call this index the “Anti-Euro Index“.

FUN FACT: Before the creation of the euro, the original USDX contained ten currencies: the ones that are currently included (except the euro), plus the West German mark, the French franc, the Italian lira, the Dutch guilder, and the Belgium franc. The euro replaced the last five of these currencies.

Because the USDX is so heavily influenced by the euro, traders have looked for a more “balanced” dollar index.

We will cover two other U.S. dollar indexes later:

As a currency trader, you should be familiar with ALL three of them.

Is the ICE U.S. Dollar Index adjusted or rebalanced?

There are no regularly scheduled adjustments or rebalancings of the ICE U.S. Dollar Index.

The Index was adjusted once when the euro was introduced as the common currency for the European Union (EU) bloc of countries.

ICE, specifically, ICE Futures U.S., monitors the index methodology to ensure that it properly reflects the covered currencies and the FX market in general and makes adjustments as and when necessary (which is like…never).

How is the U.S. Dollar Index calculated?

The ICE U.S. Dollar Index is calculated in real-time approximately every 15 seconds. This real-time calculation is redistributed to all data vendors.

The prices of the DX futures contracts are set by the market, and reflect interest rate differentials between the respective currencies and the U.S. dollar.

Where can I get real-time prices for the ICE U.S. Dollar Index?

The real-time prices for the underlying cash U.S. Dollar Index and for futures contracts based on the U.S. Dollar Index are available from market data vendors and on WebICE (an Internet-based subscription service that provides real-time access to trading activity on the ICE trading platform).

Basically, since ICE controls the price data, and they charge a fee for the data feed, access to a real-time fee does not come FREE!

Delayed prices for the cash U.S. Dollar Index can be found on websites such as Bloomberg, MarketWatch, CNBC, WSJ, and Yahoo! Finance.

Delayed prices for ICE U.S. Dollar Index futures are available on the ICE website.